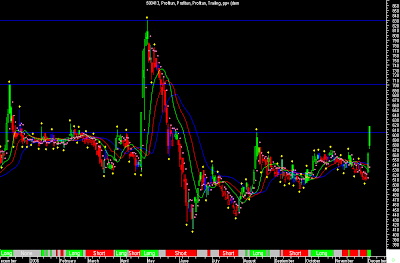

If it hadnt been for the 300+ points crack we saw on the nifty a fortnight back, Titan was poised to scale new highs. As suggested earlier, Titan finally came into its own on the last trading day of 2006, rising 8% on volumes three times the last 5 days average. Titan should now target 895-905-940, with stoploss placed at 825 and support at 848. Enjoy !

31 December, 2006

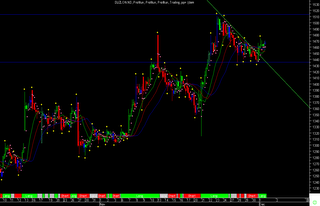

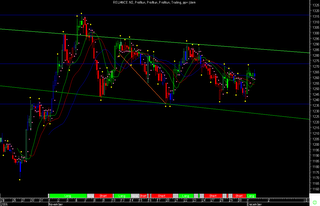

Mcdowell

Another one of the new additions to Futures and Options segment, this scrip is an old favourite of mine. It rose over 4% on friday but lost all intraday gains and eventually ended in the red on friday. As long as 859 EOD holds, Mcdowell is set to test 940 levels in the short term, with an eventual target of 1000+ .... enjoy !

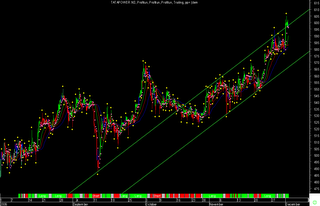

Aban Offshore

A new entrant to Futures and Options segment from 29th Dec, this scrip has been exhibiting strong momentum and is a buy on all declines with EOD stops @ 1058. With the 52w high of 1449 close at hand, expect to see Aban target 1600 in the short term. Enjoy !

The Year that was ... and the road ahead !

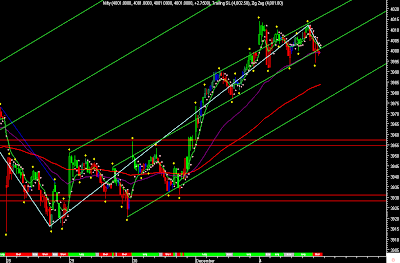

Its been an eventful 2006, to say the least, for the Indian stock markets. Nifty closed 2005 at 2836.55, from where it rose to the highs of 3774.14 in May 2006, only to crash vertically to a low of 2595.64 by June 2006 itself ! The rise from thereon has been nothing short of amazing, what with the so-called pundits painting a doomsday scenario and predicting a 'fair value' of the Indian stock markets at 2150-2300 nifty. Well, well, well ... the stock markets have a penchant of making a joker out of everyone who professes to predict what it will do and boy, oh, boy ! did we have a bunch of jokers this year ! :-)

The lows witnessed in June were not seen again and the Nifty not only managed to recover the losses but rose to a new alltime high of 4046.85 in Dec 2006, finally ending the year 2006 at 3966.39 !

Which brings us to the question that all of us would have uppermost in our mind ... where is the Nifty headed in 2007 ?? Lets try and do some crystal-gazing ;-)

First, the downside ... my view is that the long term uptrend would remain intact as long as 3330 holds on the Nifty. The medium term trend would remain up as long as 3660 holds. And as to the short term trend, 3785 would be the level to watch out for. The short term up targets for Nifty are 4100-4125 for now and sustaining above 4100 levels would see a medium term target of 4300-4500, with an eventual target of around 4700.

It would be naive to assume that we would achieve the up targets first in one long upmove, just as it would be naive to assume that we would fall all the way down to 3330, exceptional circumstances like May 2006 not withstanding. We have seen how the brute force of money can turn things upside down, no matter how good the India story might be. The ride from here on could be choppier, with the base having shifted to higher volatility. The recent crack in Nifty three weeks ago would be a case in point, where it lost 10% of its value in a matter of three days !

Its no longer going to be a joyride, I feel ... and the faint-hearted would do well not to venture into deep waters. The India story is intact and it would remain so for the next three years at least. 2010 would be the litmus test that would decide where we go from thereon ... to either becoming a developed nation by 2020 that would be a world leader in more ways than one or to an also-ran developing country that showed a lot of promise but never really lived up to it.

As 2006 draws to an end, lets raise a toast to a brave new India .... on the road to fulfilling its potential with an eventual "Tryst with Destiny", to quote Pandit Nehru. The road to success is paved with failure, it is said ... and India has had its share of failures, no doubt. But perseverance leads to triumph, against all odds.

Let the dawn of 2007 see my India marching confidently ahead on the road to success !!

Tathastu .. Inshaallah .. Amen !

The lows witnessed in June were not seen again and the Nifty not only managed to recover the losses but rose to a new alltime high of 4046.85 in Dec 2006, finally ending the year 2006 at 3966.39 !

Which brings us to the question that all of us would have uppermost in our mind ... where is the Nifty headed in 2007 ?? Lets try and do some crystal-gazing ;-)

First, the downside ... my view is that the long term uptrend would remain intact as long as 3330 holds on the Nifty. The medium term trend would remain up as long as 3660 holds. And as to the short term trend, 3785 would be the level to watch out for. The short term up targets for Nifty are 4100-4125 for now and sustaining above 4100 levels would see a medium term target of 4300-4500, with an eventual target of around 4700.

It would be naive to assume that we would achieve the up targets first in one long upmove, just as it would be naive to assume that we would fall all the way down to 3330, exceptional circumstances like May 2006 not withstanding. We have seen how the brute force of money can turn things upside down, no matter how good the India story might be. The ride from here on could be choppier, with the base having shifted to higher volatility. The recent crack in Nifty three weeks ago would be a case in point, where it lost 10% of its value in a matter of three days !

Its no longer going to be a joyride, I feel ... and the faint-hearted would do well not to venture into deep waters. The India story is intact and it would remain so for the next three years at least. 2010 would be the litmus test that would decide where we go from thereon ... to either becoming a developed nation by 2020 that would be a world leader in more ways than one or to an also-ran developing country that showed a lot of promise but never really lived up to it.

As 2006 draws to an end, lets raise a toast to a brave new India .... on the road to fulfilling its potential with an eventual "Tryst with Destiny", to quote Pandit Nehru. The road to success is paved with failure, it is said ... and India has had its share of failures, no doubt. But perseverance leads to triumph, against all odds.

Let the dawn of 2007 see my India marching confidently ahead on the road to success !!

Tathastu .. Inshaallah .. Amen !

25 December, 2006

21 December, 2006

19 December, 2006

Maruti

Finally Maruti was able to break above the congestion zone of 905-917 today. Crossover of 925 will take it to 939-942 tomorrow. Look to buy with stops @ 909. Close above 948 would see the scrip attempt 958-967 in the coming days. Enjoy !

18 December, 2006

15 December, 2006

NIFTY

13 December, 2006

12 December, 2006

11 December, 2006

08 December, 2006

07 December, 2006

ASHOKLEYAND

MAGNETS OR CUSHIONS

05 December, 2006

Titan

A darling of the last bull run before the May 2006 crash, Titan has been ranged between 750-810 for the past three months. Monday's upmove could be the signal of things to come. As long as 798 holds, it should target 850-900.

ONGC

A triangle has formed and a break on either side is expected in the next 2-3 trading sessions. Below 840, it can fall to 805 levels. A break on the upside would target 885-900. Trade accordingly.

Bharat Petroleum

The OMCs have seen a selloff in the past few days .... and though the outlook for them remains iffy till the time they are given complete pricing autonomy by the govt, expect to see a pullback from the oversold zones. BPCL seems to be holding support @ 340 levels and could see an upmove to 354.

04 December, 2006

THOMAS COOK

01 December, 2006

Subscribe to:

Posts (Atom)